The FI4INN project, a cornerstone initiative for innovation finance in Central Europe, recently concluded its third Exchange of Experience (EoE3) meeting in Klagenfurt from October 2-4, 2024. This event convened project partners, regional stakeholders, and expert speakers to discuss sustainable financial models, regional innovation ecosystems, and the evolving role of Environmental, Social, and Governance (ESG) practices within the startup sector. The gathering underscored FI4INN’s commitment to fostering a resilient ecosystem where Central European startups can thrive in an increasingly competitive and environmentally conscious market.

Sustainable Growth through ESG Integration

Environmental, Social, and Governance (ESG) principles have become crucial differentiators for startups, not only in attracting investment but in building sustainable, competitive businesses. During the event, a dedicated session on ESG integration outlined the role of these principles in startup business models, with expert Jirina Ley highlighting the importance of embedding sustainability into product design, supply chain management, and stakeholder engagement. Her insights underscored that startups implementing ESG practices are better positioned to attract eco-conscious consumers, investors, and talented employees who prioritize working for socially responsible companies.

Key recommendations included:

- Targeted Support for Green Startups: Support mechanisms for green startups were suggested, such as “impact venture capital funds” focused on climate-tech and AI-driven solutions that prioritize sustainable innovation.

- Accelerated Commercialization of Research: Partnerships with universities and research institutions are vital for green startups aiming to leverage cutting-edge sustainability research and scale innovative solutions.

- Blended Finance Models: To incentivize private investment in ESG-aligned projects, the concept of blended finance—combining public and private capital—was introduced as a means to reduce investor risk while expanding funding availability for impactful projects.

Triple Chasm Model: Navigating Growth Stages for Startups

In a climate where scaling poses significant challenges, the Triple Chasm Model was presented as an effective framework to support technology startups as they grow from concept to commercial success. This model, which addresses key “chasms” or growth phases, provides startups with a data-driven roadmap to manage transition points, such as securing market fit, expanding customer bases, and scaling operations. Each phase is backed by practical tools like the Triple Chasm Navigator, enabling startups to assess maturity, pinpoint gaps, and devise strategies to bridge these critical stages.

The model also emphasizes nine “vectors of growth,” which cover factors from market definition to intellectual property (IP) management. Workshop sessions demonstrated the model’s use for diagnosing current startup challenges and building tailored growth strategies, making it a powerful tool for startup coaches, investors, and commercialization agencies alike.

Tools for Sustainability: Green Transformation Cards and Canvas

The Green Tech Valley Cluster introduced two practical tools—the Green Transformation Cards and Canvas—which provide businesses with actionable frameworks to plan and execute sustainable transformations. The Green Transformation Cards offer a structured approach to prioritizing climate-neutrality initiatives across 10 categories, including supply chain management, eco-design, and strategy. These cards guide companies in understanding and addressing their environmental impacts through over 100 action points tailored to meet EU Green Deal standards.

Building on the card framework, the Green Transformation Canvas facilitates hands-on workshops, allowing companies to create step-by-step plans that align with their sustainability targets. By identifying current status, setting measurable goals, and outlining next steps, companies can chart a clear path to climate neutrality, making these tools accessible for businesses of all sizes looking to adopt greener practices.

Building Carinthia’s Startup Ecosystem: Local and Regional Support Programs

Central to the discussions were presentations on the innovation ecosystem in Carinthia, particularly focusing on the programs available to foster growth among early-stage startups. KWF (Carinthian Economic Promotion Fund) showcased its initiatives such as vor.Gründen, a funding program specifically for pre-startup ventures, and Innovations.TALENT, a skill-building program for R&D professionals in local companies. These programs reflect Carinthia’s commitment to nurturing startups and fostering a culture of innovation by providing targeted financial support, mentorship, and skill development.

In addition, the Carinthian Venture Fund (CVF) was highlighted as a key regional resource, providing capital investments to scalable startups with a focus on local growth. The fund’s co-investment approach, which typically splits investments with private investors on a 50:50 basis, ensures that public funding is effectively leveraged to maximize impact. By prioritizing clear decision-making processes and encouraging collaboration between stakeholders, the CVF exemplifies how well-structured regional funds can drive sustainable entrepreneurship.

Peer Learning and the Role of Design Thinking in Financial Innovation

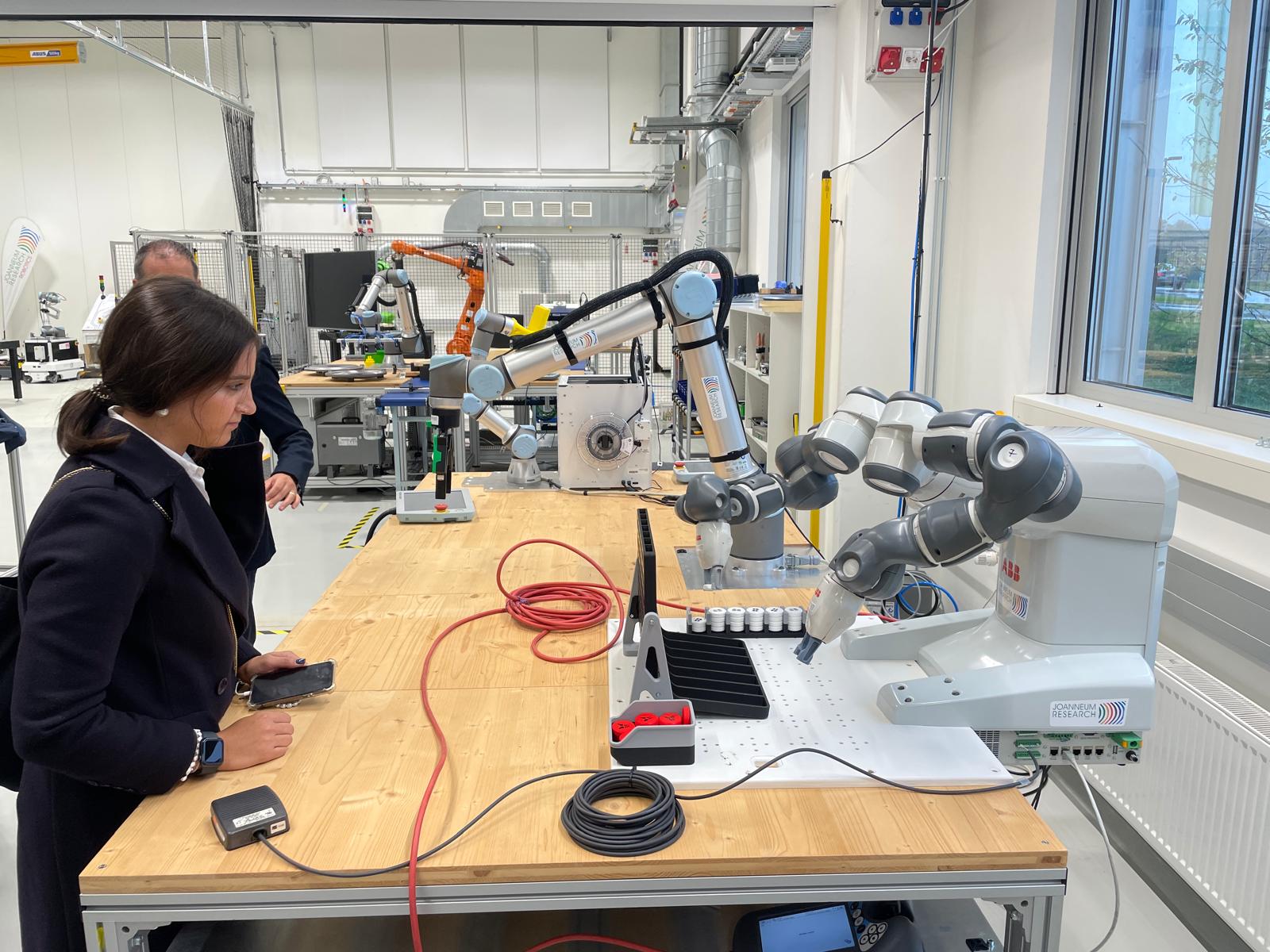

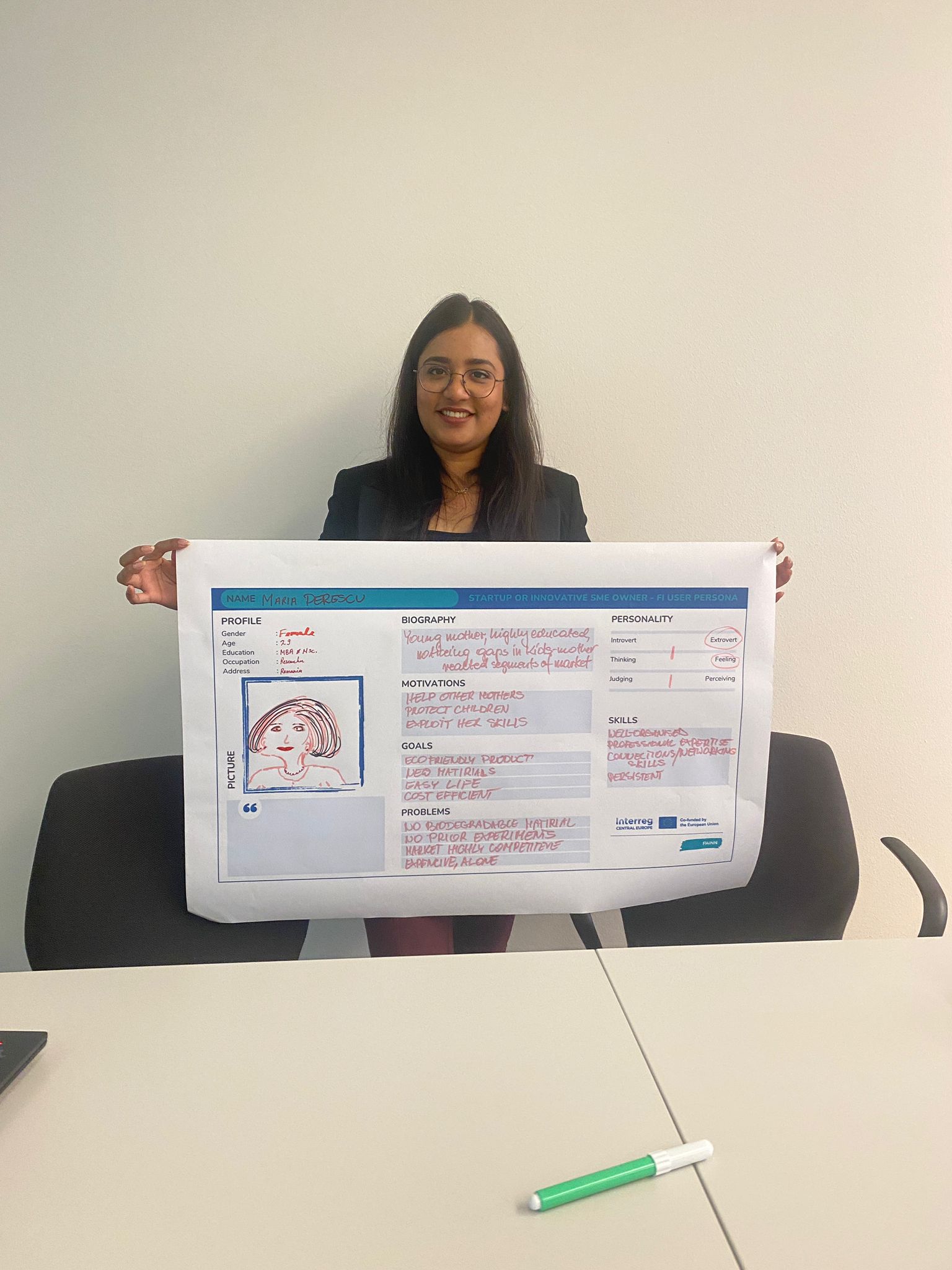

A notable feature of the meeting was the collaborative stakeholder co-creation workshop, which utilized design thinking to prototype new financial solutions tailored to startups and SMEs. Through methods like user personas and problem trees, participants mapped out the financial barriers startups face and devised solutions to integrate social and environmental objectives. The outcomes of this workshop will guide the creation of pilot actions, aligning with FI4INN’s broader goal of developing specific financial instruments that address regional needs.

The design thinking methodology facilitated a productive environment for knowledge-sharing, allowing participants to brainstorm impactful financial solutions that will soon be tested in FI4INN’s pilot programs. These solutions, informed by a deep understanding of local challenges, aim to provide adaptive funding mechanisms that are transparent, efficient, and ESG-aligned.

Moving Forward with FI4INN’s Vision for Central Europe

The third Exchange of Experience meeting in Klagenfurt underscored the value of transnational knowledge-sharing in developing a robust, impact-oriented ecosystem for startups. By focusing on inclusive financing models, sustainable business practices, and strategic partnerships, FI4INN is building a foundation where Central European startups can thrive amid the evolving demands of a global market.

FI4INN’s approach—rooted in adaptability, regional collaboration, and innovative funding mechanisms—promises to catalyze a more resilient and socially responsible entrepreneurial landscape. With ongoing initiatives like the Carinthian Venture Fund, stakeholder-driven financial instruments, and practical tools for ESG integration, FI4INN is well-positioned to drive impactful change across Central Europe, empowering startups to lead in sustainability, innovation, and economic growth.

As the project moves forward, FI4INN will continue to host these critical exchanges, ensuring that the lessons learned in each region contribute to a shared vision for sustainable innovation across Central Europe.