I.4.1 Legal Framework

The regulatory framework for the management of Interreg CE as well as any other EU-funded projects is based on the Financial Regulation of the European Parliament and of the Council on the financial rules applicable to the general budget of the Union and repealing Council Regulation (EC, Euratom) No 966/2012.

Furthermore, all general rules concerning the structural and investment funds are also applicable. The following legal norms and documents apply (non-exhaustive list):

- Regulation (EU) 2021/1060 laying down common provisions on the European Regional Development Fund, the European Social Fund Plus, the Cohesion Fund, the Just Transition Fund and the European Maritime, Fisheries and Aquaculture Fund and financial rules for those and for the Asylum, Migration and Integration Fund, the Internal Security Fund and the Instrument for Financial Support for Border Management and Visa Policy (Common Provisions Regulation – CPR);

- Regulation (EU) 2021/1058 on the European Regional Development Fund and on the Cohesion Fund (ERDF Regulation);

- Regulation (EU) 2021/1059 on specific provisions for the European territorial cooperation goal (Interreg) supported by the European Regional Development Fund and external financing instruments (Interreg Regulation);

- Implementing acts and delegated acts adopted in accordance with the aforementioned regulations;

- Other regulations, directives, decisions and rulings applicable to the implementation of projects co-funded by the ERDF;

All above regulations are available in their latest version in the EUR-Lex database of European Union Law at https://eur-lex.europa.eu/homepage.html.

In case of amendment of the above-mentioned legal norms and documents, the latest version applies.

Last but not least the Interreg CE Programme document (IP) gives the legal framework for the implementation of the programme.

I.4.2 General Eligibility Rules

I.4.2.1 Hierarchy of Rules

The hierarchy of rules on eligibility of expenditure applicable to Interreg projects is as follows:

- EU rules on eligibility as set out in the CPR, ERDF Regulation and Interreg Regulation;

- Programme eligibility rules as set out in this document;

- National (including institutional) eligibility rules. Such rules only apply for matters not covered by eligibility rules set in the abovementioned EU and programme rules.

This hierarchy of rules only applies to eligibility rules of expenditure. All applicable EU and national rules, apart from eligibility of expenditure, are on a higher hierarchical level than rules set by the Interreg CE Programme and must therefore be followed (e.g. procurement law). In such cases, the partner has to follow the stricter applicable rule.

I.4.2.2 General Eligibility Principles

Expenditure is eligible for funding when fulfilling all general eligibility requirements listed below. Therefore, expenditure has to:

- Be incurred and paid (except for costs calculated as flat rates or lump sums) by a beneficiary for implementing a project through actions as identified in the latest approved application form, in the period between the project start and end date[1];

- Be essential for the achievement of the project objectives/outputs and it would not be incurred if the project is not carried out (additionality principle);

- Relate to cost items that did not receive support from other EU Funds or other contributions from third parties[2];

- Comply with the principle of real costs except for costs calculated as flat rates and lump sums;

- Comply with the principle of sound financial management;

- Be registered in the beneficiary’s accounts through a separate accounting system or an adequate accounting code set in place specifically for the project (with the exception of costs calculated as flat rates and lump sums);

- Be not in contradiction with any specific eligibility criterion applicable to the respective cost category (see chapter I.4.3);

- Observe all relevant procurement rules, if applicable;

- Be validated by an authorised national controller.

I.4.2.3 Non-Eligible Expenditure

The following costs are not eligible:

- Interest on debts;

- Purchase of land;

- Value added tax (VAT) if the total cost of the project is at least EUR 5.000.000 (including VAT) or if the partner receives State aid within the project under the General Block Exemption Regulation (GBER). In such cases only non-recoverable VAT under national VAT legislation is eligible.[3]

- Fines, financial penalties and expenditure on legal disputes and litigation;

- Costs of gifts;

- Costs related to fluctuation of foreign exchange rate;

- In-kind contributions, (including unpaid voluntary work);

- Splitting cost items among project partners (i.e. sharing of common costs);

- Discounts not considered when claiming the costs (only the discounted amount is to be regarded as eligible);

- Expenditure supporting relocation;

- Fees between beneficiaries of a same project for services, equipment, infrastructure and works carried out within the project.

I.4.2.4 Expenditure Supported by Financial Contributions from Third Parties

As a general principle a beneficiary of the Interreg CE Programme cannot make any financial gain or direct profit[4] from the received ERDF contribution. This means that financial contributions from third parties (e.g. from national, regional or local sources) specifically assigned to finance eligible costs of the project or any of its actions which are fully (i.e. 100 %) covering the concerned project expenditure make such expenditure ineligible.

However, in case of partial financial contributions from third parties specifically assigned to finance eligible costs of the project or any of its actions, the related costs can be considered as eligible only if the financial contribution does not exceed the share of beneficiary’s contribution to that expenditure (i.e. 20 %). If this financial contribution exceeds the share of beneficiary’s contribution, the ERDF contribution from the programme has to be reduced by the amount exceeding the share of beneficiary’s contribution to the expenditure.

Specific limitations in this respect apply to partners receiving State aid from the programme under the GBER regime. For further information, please refer to chapter I.4.4.3.

Financial contributions from third parties that may be used by the beneficiary to cover other costs than those eligible under the approved project shall not be considered as financial contributions specifically assigned to the financing of project eligible expenditure.

I.4.2.5 Time-Wise Eligibility

From a time-wise perspective, expenditure is eligible according to the following three phases:

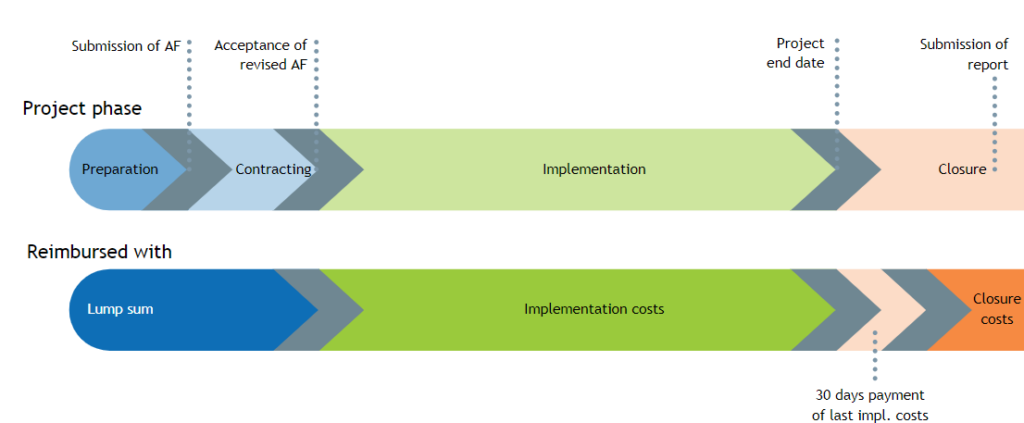

Project Preparation and Contracting Phase

Costs for the preparation and contracting of an approved project can be compensated through a lump sum under the terms and conditions further explained in chapter III.1.4. The date of the MA/JS acceptance of the revised application form fulfilling all conditions for approval (if applicable) is also the date in which preparation and contracting activities end. If a project starts its implementation phase before the project preparation and contracting phase is finalised, real costs linked to preparation and contracting (e.g. staff, external expertise and services) cannot be charged under implementation costs.

Project Implementation Phase

Costs for the implementation of an approved project are eligible from its start date until its end date as set in the subsidy contract. At the earliest, costs are eligible as from the day after submitting the application form to the MA/JS, provided that this day is the official start date of the project indicated in the subsidy contract. On this basis, partners may decide at their own risk to start the implementation of the project even before the MC decision for funding.

Payment of costs incurred in the last reporting period must take place at the latest within 30 days after the project end date. As an exception, staff costs (including social charges) referring to the last month of project implementation can be paid after this deadline, however not later than the due date of submission of the last joint activity and joint finance reports. Costs paid after these dates shall be regarded as not eligible even if incurred during the project implementation phase.

Project Closure Phase

Closure costs of a project refer to activities such as the preparation and submission of the last joint activity and joint finance reports and the control of expenditure of the last reporting period. Costs referring to these activities are eligible and must be paid by the deadline for submitting the last joint activity and joint finance reports as set in the subsidy contract. If an extension of the deadline for submission of the mentioned reports is granted by the MA/JS, the postponed date applies. The beneficiary shall provide the respective confirmation received from the MA/JS to the national controller.

The time-wise eligibility of expenditure is visualised in the following figure.

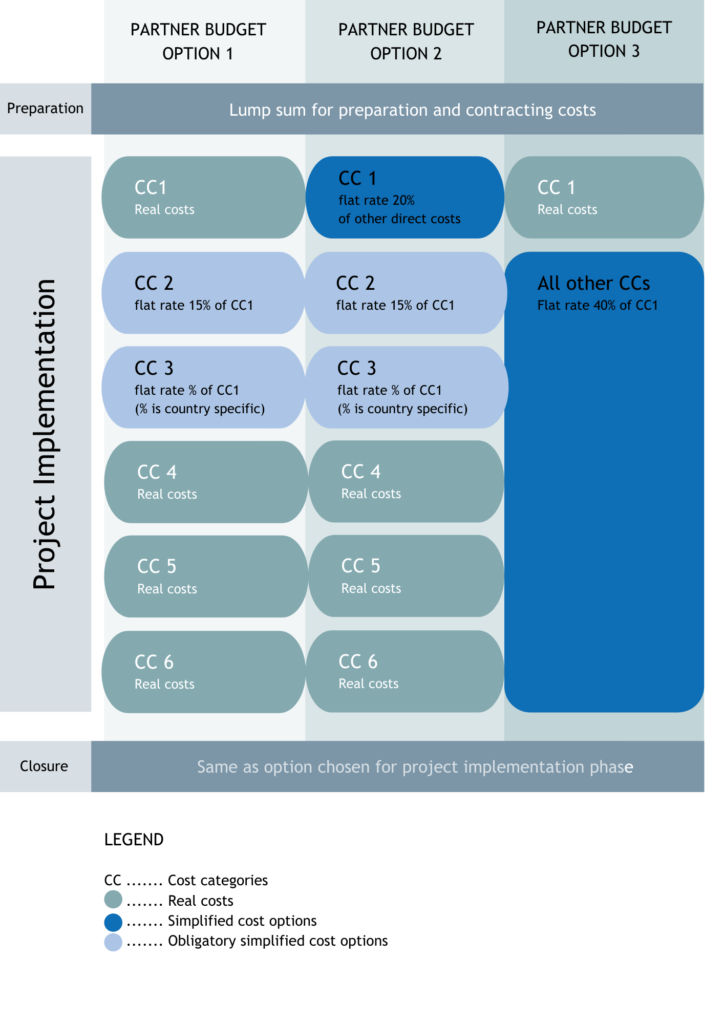

I.4.2.6 Simplified Cost Options

So as to substantially reduce any unnecessary administrative burden, the Interreg CE Programme applies a number of simplified cost options (SCOs). A brief summary of the applicable SCOs is available below, with more information provided in the indicated chapters.

Lump Sum for Preparation and Contracting Costs

Approved projects which finalise and sign the subsidy contract with the MA are entitled to the reimbursement of their preparation and contracting costs in the form of a lump sum. More information on the terms and conditions of the lump sum can be found in chapter III.1.4.

20% Flat Rate for Staff Costs

Staff costs of the beneficiary can be reimbursed on the basis of a flat rate of 20% of direct costs (i.e. cost categories 4-6) other than staff costs. Under this option, the beneficiary does not need to document that the expenditure has been incurred and paid out. For further requirements applicable to staff costs reimbursed according to a flat rate of 20% refer to chapter I.4.3.1.

15% Flat Rate for Office and Administrative Costs

The Interreg CE Programme reimburses office and administrative expenditure according to a flat rate of 15% of eligible direct staff costs. This form of reimbursement is obligatory for all beneficiaries with the exception of those beneficiaries opting for the 40% flat rate for eligible direct costs other than direct staff costs (see below). In such cases, office and administrative costs are already incorporated in the 40% flat rate. For more detailed information about office and administrative expenditure refer to chapter I.4.3.2.

Flat Rate for Travel and Accommodation Costs

The Interreg CE Programme reimburses travel and accommodation costs solely through a flat rate percentage of eligible direct staff costs. The applicable flat rate is determined according to the country where a beneficiary is located. This form of reimbursement is obligatory for all beneficiaries with the exception of those beneficiaries opting for the 40% flat rate for eligible direct costs other than direct staff costs (see below). In such cases, travel and accommodation costs are already incorporated in the 40% flat rate. For more detailed information about travel and accommodation costs refer to chapter I.4.3.3.

40% Flat Rate for Eligible Direct Costs other than Direct Staff Costs

All eligible direct costs of a beneficiary other than staff costs (i.e. cost categories 2-6) can be reimbursed on the basis of a flat rate of 40% of direct staff costs. If this option is selected, the beneficiary does not need to document that the expenditure has been incurred and paid out.

Each beneficiary must choose whether to opt for this flat rate already when drafting the application form. Since staff costs are the basis of this calculation, this option cannot be selected in combination with the20% flat rate for staff costs.

| Example: A beneficiary from Italy participating in an Interreg CE project has claimed EUR 50.000 of staff costs in financial reporting period 1. Such costs have been confirmed as eligible by the beneficiary’s controller in compliance with general and specific provisions on eligibility of expenditure as outlined in this manual. The eligible amount for direct costs (other than direct staff costs) claimed in the financial reporting period 1 is calculated as follows: EUR 50.000 * 40% = EUR 20.000 |

The chart below provides an overview of the three possible combinations of SCOs that can be selected by beneficiaries (unless otherwise specified in the respective ToR of the call):

I.4.3 Cost Categories

The Interreg CE Programme applies six different cost categories (CCs). This chapter gives specific provisions regarding the eligibility, form of reimbursement as well as reporting and audit trail[5] on each of these CCs:

- Staff costs

- Office and administrative costs

- Travel and accommodation costs

- External expertise and services costs

- Equipment costs

- Costs for infrastructure and works

I.4.3.1 Staff Costs (CC1)

Definition

Staff costs expenditure consists of the gross employment costs of staff employed by the beneficiary for implementing the project. Staff can either be already employed by the beneficiary or contracted specifically for the project. Staff may be employed vis-à-vis the project by the beneficiary either on a full-time basis (i.e. employee works 100% of their time on the project) or on a part-time basis with a fixed percentage of time per month dedicated to the project.

Expenditure included under this cost category is limited to:

- Salary payments fixed in an employment document (employment contract or any other equivalent legal agreement that permits the identification of the employment relationship with the partner’s organisation) or by law relating to responsibilities specified in the job description of the staff member concerned. Salary payments have to relate to activities which the beneficiary would not carry out if the project concerned was not undertaken.

- Any other costs directly linked to salary payments incurred and paid by the employer (such as employment taxes and social security including pensions)[6], provided that they are:

- Fixed in an employment document or by law;

- In accordance with the legislation referred to in the employment document and with standard practices in the country and/or institution where the individual staff member is working;

- Not recoverable by the employer.

Payments to natural persons working for the beneficiary under a contract other than an employment contract may be assimilated to salary payments and such a contract is considered as an employment document. Such costs are eligible if all the following conditions are respected:

- The person works under the beneficiary’s instructions and, unless otherwise agreed with the beneficiary, on the beneficiary’s premises; and

- The result of the work carried out belongs to the beneficiary; and

- The costs are not significantly different from those for personnel performing similar tasks under an employment contract with the beneficiary.

The beneficiary has to clarify the above conditions against the applicable national (including institutional) labour rules. The beneficiary is recommended to prior consult with its national controller in order to identify possible risks of ineligibility of such expenditure.

Forms of Reimbursement

Staff costs of a beneficiary can be reimbursed on the basis of one of the following two options:

A. Real costs where the beneficiary must document that expenditure has been incurred and paid out; or

B. Flat rate of 20% of direct costs other than staff costs (i.e. cost categories 4 to 6), where the beneficiary does not need to document that the expenditure has been incurred and paid out.

Each beneficiary in a project must choose one of the above reimbursement options already when drafting the application form. The same reimbursement option will then apply to all staff members of the beneficiary working in this project and it will be set for the entire project duration. The chosen option cannot be changed during project implementation.

Option A.: Real Costs

Additional Eligibility Requirements for Staff Costs Calculated on a Real Costs Basis

For staff costs calculated on a real costs basis, the following additional eligibility requirements apply:

- The adequacy of staff costs must always be ensured. When claimed staff costs are not adequate in quality and/or quantity to the realised project deliverables and outputs listed in the approved application form, a flat rate correction may be applied following the principle of proportionality.

- Taxable benefits are only eligible if foreseen in the signed contract, and/or in national and internal regulations, and if they are in line with the employment policy of the beneficiary organisation (ad-hoc regulations applicable only to the project are not allowed). They must be directly linked to the salary payments and figure on the payslip.

- Unjustified ad-hoc salary increases or bonuses for project purposes are not eligible.

- Where foreseen by the employment document, overtime is eligible, provided it is in conformity with national legislation and the standard practice of the beneficiary organisation.

- Staff costs must be calculated individually for each staff member charged to the project.

Calculation of Costs for Staff Working Full-time in the Project

For individuals that are employed by the beneficiary to work full-time on the project, the total gross employment costs incurred by the employer are considered as eligible if they are in line with the general provisions on eligibility (see chapter I.4.2.2) and if the above-mentioned additional eligibility requirements for staff costs are determined on a real costs basis. The fact that the individual works full-time on the project has to be clearly stated either in the employment document itself or in a task assignment document (see more detailed information below).

Calculation of Costs for Staff Working Part-Time with a Fixed Percentage of Time per Month on the Project

For individuals employed by the beneficiary and assigned to work part of their time on the project, eligible costs shall only be calculated as a fixed percentage of working time spent by an employee on the project per month. This percentage should be either directly set in the employment document or in a specific task assignment document (see more detailed information below). The percentage of the assignment has to reflect an employee’s related tasks, responsibilities and functions to be performed in the project and shall be individually fixed for each employee.

The percentage cannot change every month. In principle, the fixed percentage could cover the whole project duration, but this percentage may also change provided this is justified due to changes in tasks or responsibilities of the employee. However, the percentage shall remain fixed for an entire financial reporting period (i.e. six months, see chapter III.2.3.3). If the percentage is changed, the employer must issue an amendment to the aforementioned assignment document setting out the fixed percentage of time worked on the project per month.

The reimbursement of staff costs shall then be calculated by applying the percentage stipulated in the working document (and/or the official assignment document of the employee to the project) to the monthly gross employment cost.

| Example: Monthly gross employment costs of the employee working on the project is EUR 5.000,00 Employee assigned to work 50% of the total working time in the Interreg CENTRAL EUROPE project. Staff costs to be claimed = Total monthly salary (gross salary) * Fixed percentage Staff costs to be claimed = EUR 5.000,00 * 50% = EUR 2.500,00 |

The Task Assignment Document

The task assignment document is crucial for calculating costs of staff working part-time on the project. However, it can also be set in place for employees working full-time in the project. It might either be part of the employment document or a separate document. In both cases, the task assignment document shall at least:

- Be issued individually for each employee and each project;

- Contain basic information on the project (project title, acronym, partner name, name of the employee);

- Indicate from when the assignment document is applicable and its version number;

- Contain a self-declaration of no double-financing of staff costs (where an employee is involved in other EU/publicly funded projects);

- Provide a description of tasks of the employee in the project, with a proportionate level of detail reflecting the indicated percentage;

- Provide the percentage of working time of the employee on the project per month;

- Be signed by the employer (supervisor, line manager etc.) and the employee.

An example of a task assignment document can be found at the programme website. This example provides the minimum compulsory requirements that are needed.

Audit Trail for Staff Costs Reimbursed on a Real Costs Basis

The following documents constitute the audit trail for staff costs reimbursed on a real costs basis:

- Employment document;

- Job description providing the necessary information on responsibilities related to the project;

- A document clearly stating the intensity of work of the employee on the project, i.e. full time (100%) or the fixed percentage of time worked by the employee on the project. It can be the employment document itself or an official task assignment document (see above);

- Periodic staff report (template available at the programme website) with a summary description of the tasks carried out and the outputs and deliverables worked on by the employee in the reporting period. The periodic staff report must be signed by both the employee and his/her supervisor;

- Payslips or other documents of equivalent probative value which allow proof of payment of gross employment costs (e.g. extract from a reliable accounting system of the beneficiary, confirmation of tax authority, bank statement).

No separate or individual working time registration system (i.e. timesheet) is needed.

Option B.: Flat Rate 20% of Direct Costs other than Staff Costs

Instead of the above real costs option, a beneficiary may also opt to calculate staff costs on a flat rate basis. The applicable flat rate is 20% of the beneficiary’s direct costs incurred in a financial reporting period (excluding staff). All costs incurred by the beneficiary and validated by the national controller under the following cost categories are to be regarded as direct costs for the purpose of calculating the flat rate:

- External expertise and services costs;

- Equipment expenditure;

- Costs for infrastructure and works.

Documented direct costs that form the basis for the staff costs calculation must be incurred and paid by the partner institution as real costs and must not include any indirect costs that cannot be directly and fully allocated to the project.

If in the framework of controls and audits described in chapter III.3, direct costs used as calculation basis for determining staff costs are found to be ineligible, the determined costs for staff must be re-calculated and reduced accordingly. Given that office and administrative costs (CC2) and travel and accommodation costs (CC3) are calculated as a flat rate of staff costs, and are not calculated on a real costs basis, this type of expenditure is not included in the calculation of the 20% flat rate of direct costs.

Each beneficiary must already choose in the application form whether to apply this option for the reimbursement of staff costs. The chosen reimbursement option will apply to all staff members of the beneficiary working on the project and it will be set for the entire project duration. The chosen option cannot be changed during project implementation.

| Example: A beneficiary participating in an Interreg CE project chose the 20% flat rate calculation method for staff cost in the application form. In the financial reporting period 1, the beneficiary incurred and reported the following direct costs, which were confirmed to be eligible by the beneficiary’s controller in compliance with general and specific provisions on eligibility of expenditure: External expertise and services: EUR 15.500,00 Equipment: EUR 1.500,00 Total amount: EUR 17.000,00 The eligible amount for staff costs claimed in the financial reporting period 1 is then calculated as follows: EUR 17.000,00 * 20% = EUR 3.400 |

Audit Trail for Staff Costs Calculated as a Flat Rate

For staff costs calculated through the flat rate, beneficiaries do not need to document that the expenditure for staff costs has been incurred and paid or that the flat rate corresponds to reality. Accordingly, no documentation on staff costs needs to be provided to the controller.

However, the beneficiary has to demonstrate that at least one employee is involved in the project. This is certified through a self-declaration issued by the beneficiary’s legal representative (or delegated person).

Small companies that employ no staff and in which work is provided by the company’s owner(s), the legal representative of the company has to issue a self-declaration certifying that the owner(s) of the company directly worked in the project.

I.4.3.2 Office and Administrative Costs (CC2)

Definition

Office and administrative costs covers operating and administrative expenses of the beneficiary that are necessary for the implementation of the project. Since office and administrative expenditure is calculated through a flat rate (see below), no distinction is made between direct and indirect costs in this cost category.

Office and administrative costs shall be limited to the following elements:

| a. Office rent; b. Insurance and taxes related to the buildings where the staff is located and to the equipment of the office (e.g. fire, theft insurances); c. Utilities (e.g. electricity, heating, water); d. Office supplies; e. Accounting; f. Archives; g. Maintenance, cleaning and repairs; h. Security; i. IT systems (operating/administrative IT services of general nature); j. Communications (e.g. telephone, internet, postal services, business cards); k. Bank charges for opening and administering the account or accounts where the implementation of the project requires a separate account to be opened; and l. Charges for transnational financial transactions. |

The above list is exhaustive and costs of all listed items are included in the flat rate. Accordingly, cost items accounted under the office and administrative cost category cannot be reimbursed under any other cost category.

Form of Reimbursement

The Interreg CE Programme reimburses office and administrative costs according to a flat rate of 15% of eligible direct staff costs.

Office and administrative costs are calculated as a flat rate regardless of the form of reimbursement applied under the staff costs category (CC1). If a beneficiary accounts staff costs through a flat rate of 20% of direct costs (excluding staff), this amount is the basis for the calculation of office and administrative expenditure.

In case the beneficiary selected the 40% flat rate for the calculation of eligible direct costs other than direct staff costs (see chapter I.4.2.6), then the said 40% also cover office and administrative costs.

| Example: A beneficiary of an Interreg CE project claimed EUR 10.000 of staff costs in financial reporting period 1. The costs were confirmed as eligible by the beneficiary’s controller in compliance with general and specific provisions on eligibility of expenditure. The eligible amount for office and administrative expenditure claimed in the financial reporting period 1 is then calculated as follows: EUR 10.000 * 15% = EUR 1.500 |

Audit Trail for Office and Administrative Costs

Beneficiaries do not need to document that expenditure for office and administrative costs have been incurred and paid or that the flat rate corresponds to reality. Accordingly, no documentation on office and administrative costs needs to be provided to the controller or kept for further controls.

If, in the framework of controls and audits described in chapter III.3, direct staff costs which were used as calculation basis for determining office and administrative expenditure are found to be ineligible, the amount of office and administrative expenditure must be re-calculated and reduced accordingly.

I.4.3.3 Travel and Accommodation Costs (CC3)

Definition

This cost category refers to the expenditure for travel and accommodation of staff of the beneficiary for missions that are necessary for the project implementation, regardless whether such costs refer to missions taking place inside or outside the programme area.

Travel and accommodation costs shall be limited to the following elements:

| 1. Travel costs (e.g. tickets, travel and car insurance, fuel, car mileage, toll, and parking fees); 2. Costs of meals; 3. Accommodation costs; 4. Visa costs; 5. Daily allowances. |

This list is exhaustive and costs of all listed items are included in the flat rate. Accordingly, cost items accounted under the travel and accommodation cost category cannot be reimbursed under any other cost category.

Form of Reimbursement

The Interreg CE Programme reimburses travel and accommodation costs only according to a flat rate of eligible direct staff costs. This flat rate is set at country level, meaning that beneficiaries located in a certain country shall calculate travel and accommodation costs according to the flat rate of their country. In case of EGTCs, the applicable rate is the one of the country in which it is registered.

The table below provides the applicable flat rate for each Interreg CE Member State:

| COUNTRY | FLAT RATE |

| Austria | 5% |

| Croatia | 11% |

| Czech Republic | 7% |

| Germany | 5% |

| Hungary | 8% |

| Italy | 6% |

| Poland | 9% |

| Slovakia | 6% |

| Slovenia | 6% |

For those beneficiaries located in an EU Member State not participating in the Interreg CE Programme, the applicable flat rate is 5%.

Travel and accommodation costs are calculated as a flat rate regardless of the form of reimbursement applied under the staff costs category. If a beneficiary accounts staff costs through a flat rate of 20% of direct costs (excluding staff), this calculated staff costs amount is the basis for the calculation of travel and accommodation costs.

In case the beneficiary selected the 40% flat rate for the calculation of eligible direct costs other than direct staff costs (see chapter I.4.2.6), the 40% also covers travel and accommodation costs.

| Example: A beneficiary from Hungary participating in an Interreg CE project claimed EUR 10.000 of staff costs in financial reporting period 1. Such costs were confirmed as eligible by the beneficiary’s controller in compliance with general and specific provisions on eligibility of expenditure. The eligible amount for travel and accommodation costs claimed in the financial reporting period 1 is calculated as follows: EUR 10.000 * 8% = EUR 800 |

Travel and accommodation costs of external experts and service providers are reimbursed under the external expertise and services cost category. The same applies to travel and accommodation costs of staff of institutions acting as associated partners.

Audit Trail for Travel and Accommodation Costs

Beneficiaries do not need to document that the expenditure for travel and accommodation costs has been incurred and paid or that the flat rate corresponds to reality. Accordingly, no documentation related to travel and accommodation costs needs to be provided to the controller.

If, in the framework of controls and audits described in chapter III.3, direct staff costs used as the calculation basis for determining travel and accommodation costs are found to be ineligible, the amount of travel and accommodation costs must be re-calculated and reduced accordingly.

I.4.3.4 External Expertise and Services Costs (CC4)

Definition

External expertise and services can be provided by a public or private body or a natural person outside of the beneficiary organisation. External expertise and services costs are paid on the basis of contracts or written agreements and against invoices or requests for reimbursement to external experts and service providers who are sub-contracted to carry out certain tasks or activities linked to the implementation of the project.

Expenditure under this cost category shall be limited to the following elements:

| a) Studies or surveys (e.g. evaluations, strategies, concept notes, design plans, handbooks); b) Training; c) Translations; d) Development, modifications and updates to IT systems and website; e) Promotion, communication, publicity or information linked to a project; f) Financial management; g) Services related to the organisation and implementation of events or meetings (including rent, catering or interpretation); h) Participation in events (e.g. registration fees); i) Legal consultancy and notarial services, technical and financial expertise, other consultancy and accountancy services; j) Intellectual property rights; k) Verification and validation of expenditure carried out by authorised national controllers; l) Provisions of guarantees by a bank or other financial institution where required by EU or national law or in the programme manual; m) Travel and accommodation for external experts, speakers, chairpersons of meetings and service providers; n) Other specific expertise and services needed for the project. |

This list is exhaustive. Accordingly, cost items accounted under the external expertise and services cost category cannot be reimbursed under any other cost category.

Form of Reimbursement

External expertise and service costs are reimbursed by the programme on a real costs basis.

Additional Eligibility Requirements

In addition to the general provisions on eligibility (see chapter I.4.2.2), the following applies:

- External expertise and services must be clearly and strictly linked to the project and be essential for its effective implementation;

- Eligibility of costs for external expertise and services is subject to the full respect of EU, national and programme procurement rules (see chapter I.4.4.1);

- Where applicable, deliverables produced by experts or service providers must respect the relevant branding requirements (see chapter I.4.4.2);

- External expertise and services have to be clearly foreseen in the application form or must have been agreed by the MA/JS beforehand in order to be considered as eligible. A prior approval of the MA/JS is not needed if amounts are below the threshold of the “budget flexibility rule” (see chapter III.4) applicable to this cost category;

- Promotional materials are eligible only if referring to items included in the programme pre-defined list of eligible materials (see chapter I.4.4.2) or if previously approved by the MA/JS;

- Complementary activities to events (e.g. site visits) must have clear and demonstrable project relevance, otherwise costs linked to them are not eligible;

- Contractual advances in accordance with normal commercial law and practice, stipulated in a contract between the beneficiary and the expert or service provider, supported by invoices are eligible but depend on later confirmation that the service has been properly and timely delivered;

- Travel and accommodation costs of staff of associated partners as well as of external speakers and external participants in project meetings and events must be incurred and paid by project beneficiaries and have to be accounted for under this cost category. Such costs must comply with applicable national and institutional rules about travel and accommodation;

- Gifts are not eligible;

- Sub-contracting between partners of a same project is not allowed.

Audit Trail for External Expertise and Services Costs

The following documents must be provided to the controller:

- Evidence of the selection procedure (if applicable), in line with EU, national or programme procurement rules, depending on the amount contracted and the type of beneficiary (see chapter I.4.4.1).

- Contract or written agreement laying down the services to be provided with a clear reference to the project and the programme. For experts paid on the basis of a daily or hourly fee, the applicable daily or hourly rate together with the number of days or hours contracted and the total amount of the contract must be provided. Any changes to the contract must comply with the applicable procurement rules and must be documented.

- Invoice or request for reimbursement providing all relevant information in line with the applicable accountancy rules as well as references to the project and the programme and a detailed description of the services provided in line with the contents of the contract. For experts paid on the basis of a daily or hourly fee, the invoice must include a clear quantification of the days or hours charged, the price per unit and the total price.

- Deliverables produced (e.g. studies, promotional materials) or, where applicable, documentation of the delivery (e.g. for events an agenda, list of participants, photo-documentation, etc.).

- Proof of payment (e.g. extract from a reliable accounting system of the beneficiary, a bank statement).

I.4.3.5 Equipment Costs (CC5)

Definition

This cost category refers to expenditure incurred by a beneficiary for equipment purchased, rented or leased other than those covered by the cost category “office and administrative costs”, which is necessary for the implementation of the project. This includes costs of equipment already in possession by the beneficiary and used to carry out project activities.

Costs of equipment shall be limited to the following elements:

| a) Office equipment; b) IT hardware and software; c) Furniture and fittings; d) Laboratory equipment; e) Machines and instruments, f) Tools or devices; g) Vehicles; h) Other specific equipment needed for the project. |

This list is exhaustive. Accordingly, cost items accounted under this cost category cannot be reimbursed under any other cost category.

It is to be noted that the purchase of consumables that do not fall under the definition of office and administrative costs (CC2) and that are necessary for the use of laboratory equipment or machines and instruments (points d and e) is eligible and should be included under this cost category (CC5).

Purchase costs of second-hand equipment may be eligible if no other assistance has been received for it from Interreg funds or other EU subsidies; if its price does not exceed the generally accepted price on the market in question; and if it has the technical characteristics necessary for the project and it complies with applicable norms and standards.

Form of Reimbursement

Equipment expenditure is reimbursed by the programme on a real costs basis.

Additional Eligibility Requirements

In addition to the general provisions on eligibility, the following applies:

- Equipment must be clearly linked to the project and be essential for its effective implementation;

- Eligibility of costs for equipment is subject to the full respect of EU, national and programme procurement rules (see chapter I.4.4.1);

- Equipment items have to be duly described in the application form or must have been agreed upon with the MA/JS beforehand in order to be considered as eligible. A prior approval of the MA/JS is not needed in case of amounts below the threshold of the “budget flexibility rule” (see chapter III.4) applicable to the equipment cost category;

- Equipment expenditure cannot refer to items already financed by other EU or third party subsidies and must not be already depreciated;

- Where applicable, equipment items must respect the relevant branding rules (see chapter I.4.4.2);

- Contractual advances in accordance with normal commercial law and practice, stipulated in a contract between the beneficiary and the supplier, supported by receipted invoices are eligible but depend on later confirmation that the equipment has been properly and timely delivered;

- Equipment cannot be purchased, rented or leased from another partner within the project.

The full purchase cost of the equipment can be regarded as eligible. However, also depreciation is eligible if in line with national rules on the matter.

Equipment for which the exclusive use in the project cannot be demonstrated shall be charged pro-rata on the basis of a transparent method set in place by the beneficiary for allocating the share of use in the project.

In principle, equipment used for project management should be bought at the early stages of project implementation.

Audit Trail for Equipment Costs

The following documents must be provided to the controller:

- Evidence of the selection procedure, in line with EU, national or programme procurement rules, depending on the amount contracted and the type of beneficiary (see chapter I.4.4.1);

- Contract or written agreement laying down the services or supplies to be provided with a clear reference to the project and the programme. For contracts including also daily or hourly fees, the applicable daily or hourly rate together with the number of days or hours contracted and the total amount of the contract must be provided. Any changes to the contract must comply with the applicable procurement rules and must be documented;

- Invoice (or a supporting document having equivalent probative value to invoices) providing all relevant information carried out in line with the contents of the contract, the applicable national accountancy rules and internal accountancy policies of the beneficiary and, where applicable, bearing references to the project and the programme. For contracts including also a daily or hourly fee, the invoice must include a clear quantification of the days or hours charged, the price per unit and the total price;

- In case depreciation is applied, a calculation scheme of depreciation;

- In case the equipment is charged pro-rata, the method set in place for allocating the share of use in the project;

- Photo documentation or any other means required to prove the existence of the equipment;

- Proof of payment (e.g. extract from a reliable accounting system of the beneficiary, a bank statement).

I.4.3.6 Costs for Infrastructure and Works (CC6)

Definition

Costs for infrastructure and works shall be limited to the following elements:

- Building permits;

- Building material;

- Labour;

- Specialised interventions (e.g. soil remediation, mine-clearing)

The above list is exhaustive. Cost items accounted under this cost category (CC6) cannot be reimbursed under any other cost category.

Costs for infrastructure and works may either refer to an object (e.g. a building) that will be set up ex-novo or to the adaptation of an already existing infrastructure. In any case these costs are only eligible if complying with programme requirements for investments (see chapters I.3.3.3 and II.2.1.2).

Costs of feasibility studies, environmental impact assessments, architectural or engineering activities and any other expertise needed for the realisation of the infrastructure, shall be allocated under the cost categories “Staff costs” or “External expertise and services costs” (depending whether carried out internally by the beneficiary or with the support of external suppliers).

Form of Reimbursement

Costs for infrastructure and works are reimbursed by the programme on a real costs basis.

Additional Eligibility Requirements

In addition to the general provisions on eligibility, the following applies:

- Costs must be clearly linked to the project and be essential for its effective implementation;

- Costs for infrastructure and works have to be in line with the approved application form or, must have been agreed with the MA/JS beforehand in order to be considered as eligible;

- Full costs for infrastructure and works within the project are eligible;

- Costs for infrastructure and works outside the Interreg CE programme area are not eligible;

- Eligibility of costs is subject to the respect of EU, national and programme procurement rules (see chapter I.4.4.1);

- Depending on the nature of the intervention to be carried out, all compulsory requirements set by EU and national legislation on environmental policies, must be fulfilled;

- Where applicable, works must have been previously authorised by national/regional/local authorities (building permits);

- The land or buildings where works will be carried out must be in the ownership of the beneficiary or the beneficiary must have set in place long-term legally binding arrangements in order to fulfil durability (including maintenance) requirements;

- Infrastructure and works expenditure cannot refer to items financed by other EU or third party subsidies and must not be already depreciated;

- In case of infrastructure and works that are part of a larger infrastructural investment funded through other sources, the part realised by the Interreg CE project must be clearly and univocally identifiable;

- Where applicable, infrastructure and works realised by the project must respect the relevant branding requirements (see chapter I.4.4.2);

- Requirements concerning durability, including ownership and maintenance, as provided for in chapter III.5, apply to infrastructure funded within a project;

- Contractual advances in accordance with normal commercial law and practice, stipulated in a contract between the beneficiary and the provider and supported by receipted invoices are eligible but depend on later confirmation that infrastructure and works have been properly and timely executed.

Audit Trail of Costs for Infrastructure and Works

The following documents must be provided to the controller:

- Legal documents specifying the ownership or long-term arrangement for the land or buildings where the works will be carried out;

- Where applicable, necessary permits for the execution of the works, issued by the national/regional/local relevant authorities;

- Evidence of the appropriate selection procedure, in line with EU, national or programme procurement rules, depending on the nature of the concerned works, the amount contracted and the type of beneficiary (see chapter I.4.4.1);

- Contract or written agreement laying down the supplies or services to be provided with a clear reference to the project and the programme. For contracts including also a daily or hourly fee, such fee together with the number of days or hours contracted and the total amount of the contract must be provided. Any changes to the contract must comply with the applicable procurement rules and must be documented;

- Invoice (or a supporting document having equivalent probative value to invoices) providing all relevant information in line with the applicable accountancy rules as well as references to the project and the programme and a detailed description of the infrastructure or works carried out in line with the contract. For contracts including also a daily or hourly fee, the invoice must include a clear quantification of the days or hours charged, the price per unit and the total price;

- Proof of payment (e.g. extract from a reliable accounting system of the beneficiary, a bank statement).

I.4.4 Horizontal Policies

I.4.4.1 Procurement Rules

General Principles

The acquisition of works, supplies or services from economic operators by means of a public contract is subject to rules on public procurement. This secures transparent and fair conditions for competing on the common market and shall be followed by the beneficiaries when procuring services, works or supplies.

Rules differ depending on the kind of goods or services to be procured, the value of the purchase and the legal status of the awarding institution. Rules are set at the following levels:

- EU rules as set by the applicable directives on the matter;

- National rules[7];

- Programme rules.

In addition to what is set out in procurement laws, all other relevant laws related to procurement (e.g. rules on contracting, intellectual property, business law, competition law etc.) are to also be observed.

Failure to comply with procurement rules set out at EU, national or programme level will have financial consequences. The Interreg CE Programme follows the “Guidelines for determining financial corrections to be made to expenditure financed by the Union for non-compliance with the aplicable rules on public procurement” [8] by applying correction rates based on the type and significance of the non-compliance.

It is strongly recommended to become familiar with the applicable procurement rules and, if necessary, to seek advice of procurement experts or national controllers early enough before launching public procurement procedure.

More information on EU rules on public procurement, including on applicable EU thresholds, can be found at https://ec.europa.eu/growth/single-market/public-procurement_en, while information on national rules on public procurement can be found on the websites of competent institutions on the matter.

Particular attention should be paid to the concept of a “sufficient degree of advertising” as included in various court rulings and communications by the EC. This concept implies that for contracts which are not (or not fully) subject to the public procurement directives, there is – besides the requirement to follow the national law – also the need to determine the existence of a certain transnational interest. For more information on this concept see the Commission Interpretative Communication No 2006/C 179/02 .

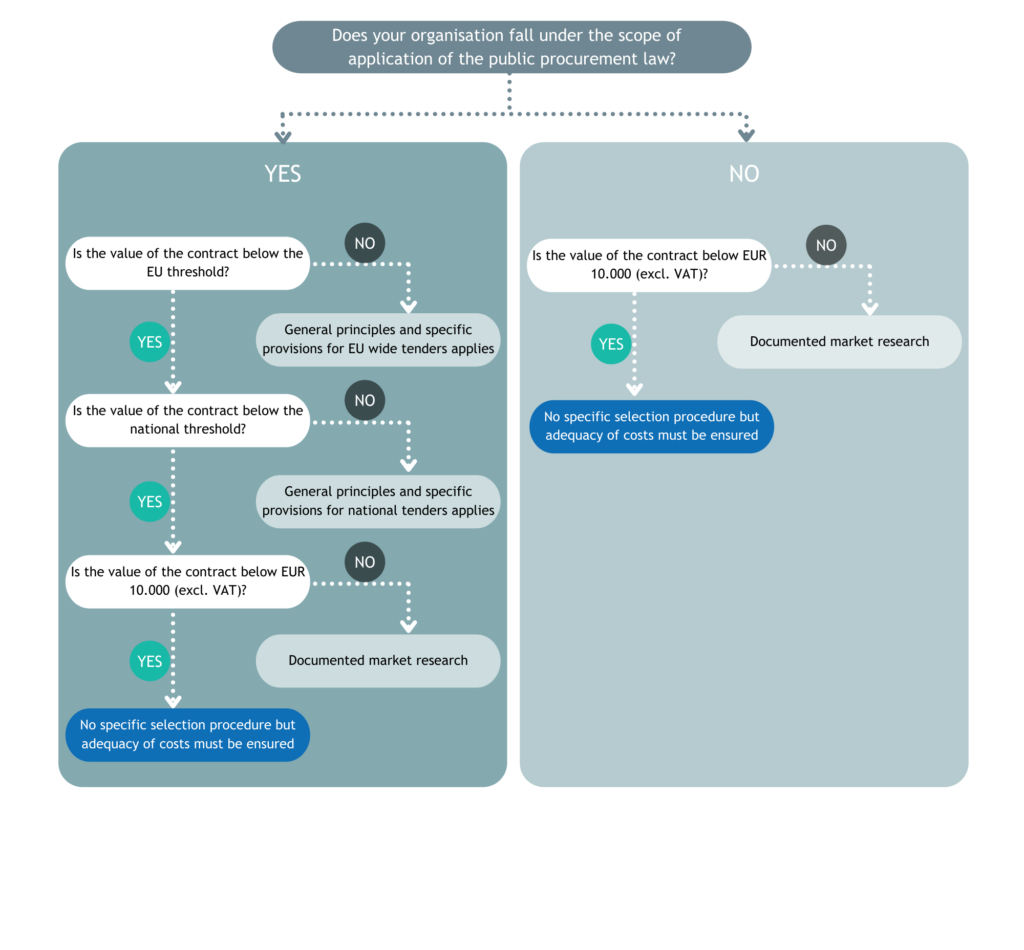

Programme Rules on Procurement

In order to guarantee a harmonised standard in contracting procedures across the programme area and to accomplish sound financial management principles, the Interreg CE Programme requires beneficiaries to give evidence of adequate market researches for contracting amounts between EUR 10.000,00 (excl. VAT) and the threshold set by the applicable EU and national rules.

This means that in such cases, unless stricter national rules apply, beneficiaries must provide evidence of an adequate market research (e.g. through collecting bids, using centralised e-procurement services). This allows to collect sufficient information on the relevant market and for sound comparison of offers in terms of price or quality and a profound assessment of the adequacy of the price.

For contracts having a value below EUR 10.000 (excl. VAT) or below the national threshold (if stricter than the programme rule), the adequacy of costs must always be ensured. However, in such cases beneficiaries do not have to give evidence of a specific selection procedure.

Scope of Application of Public Procurement Rules

As mentioned above, different rules apply. Their applicability might depend, among others, on the legal status of the awarding institution. In this regard the following is to be kept in mind:

- Public authorities and other institutions falling under the scope of procurement laws (including international organisations) must comply with the applicable rules on public procurement.

- Unless stricter rules apply, institutions not falling under the scope of public procurement laws (e.g. private institutions) must provide evidence of an adequate market research (e.g. through collecting bids), for estimated contract values above EUR 10.000,00 (excl. VAT), as described above.

Selection of the Awarding Procedure

Beneficiaries must choose the appropriate procedure on the basis of an accurate assessment of the value of the future contract, keeping in mind that the artificial splitting of contracts in order to remain below a certain threshold violates the law. The (appropriate) estimated value of a contract is the basis for the selection of the procurement procedure to be conducted and accordingly determines the range of the publicity required for the respective procurement.

Once the value of a contract is determined, the following decision tree supports the choice of procedure to be applied.

Conflict of Interest

A conflict of interest exists where the impartial and objective exercise of the functions of a financial actor or other person, is compromised for reasons involving family, emotional life, political or national affinity, economic interest or any other shared interest with a recipient. Each beneficiary is responsible for ensuring that appropriate measures are taken to minimise any risk of conflict of interest during the procurement process.

Although the character of conflicts of interest can be diverse depending on the parties, types of the relationships and interests involved, transparency of the decision-making process and fair treatment for all tenderers is to be ensured. Special attention should be given to cases where project staff is also involved in external companies participating in the tenders organised by the respective project partner. In any case, measures need to be carefully analysed to minimise any possible risk of conflict of interest.

A comprehensive guidance on the avoidance and management of conflicts of interest is available at https://ec.europa.eu/info/strategy/eu-budget/protection-eu-budget/conflict-interest_en.

Exemption from Procurement Rules

The following exemptions from procurement rules apply:

- In-house contracting: Requirements from the latest EU Directive on public procurement[9] imply that:

- The contracting authority exercises over the contracted in-house body a control, which is similar to that which it exercises over its own departments;

- More than 80% of the activities of the controlled body are carried out for the controlling contracting authority;

- There is no direct private capital participation in the controlled body.[10]

- When all the above conditions for an in-house contracting are met, the in-house body can be contracted by the beneficiary through a direct award. Costs of the contracted in-house body must always be charged on a real costs basis or using Simplified Cost Options (SCOs) in the same way as the project partner. Such costs shall be accounted under each relevant cost category, according to the nature of the service provided, as well as under the same general and specific provisions on eligibility, reporting and audit trail as provided for in this manual.

- Contracts for cooperation between public bodies: Requirements deriving from the EU Directive on public procurement also apply in this case.[11]

Project Partners vs. External Experts or Providers

The Interreg CE Programme does not allow project partners to contract each other to carry out project activities. At the same time, organisations must not be incorporated into the partnership with the intention to undermine procurement laws. This in particular concerns bodies whose main scope of activities, within their business profile as well as their project role, consists of project coordination, management, communication, knowledge management or other activities that are of a mere executive or supporting character (i.e. service providers).

I.4.4.2 Branding and Visibility

Co-funded projects have to acknowledge and promote the ERDF support received in all their activities.[12] The approach to harmonise branding across the programme, including all project branding, has been a cornerstone of communication in Interreg CE since 2014. It has helped to facilitate project branding, reduce costs and help raise awareness on activities and results reached with ERDF support.

This approach is continued and projects are obliged to follow the programme’s brand design in all activities.

Use of Project Logo

Project logos are based on the programme logo. These logos respect all requirements set out in the EU regulations 2021/1059 and 2021/1060 and are provided by the programme to the projects.

Projects are under no circumstance allowed to develop their own project logos. However, specific logos might be considered for outputs with a lifetime that goes well beyond the project duration. In such rather exceptional cases, prior approval of the MA/JS has to be requested before the activity is implemented.

Project logos have to be placed on the front cover of all publications and documents. In videos, the logo has to be integrated in a reasonable size at the beginning as well as at the end of the video. On websites and their subpages, online and smartphone applications, social media channels and other digital platforms, the logo has to be positioned in a place which is visible on top without scrolling or clicking. On other communication products such as conference bags or exhibition roll-ups, it also has to be placed in a prominent place.

The size of the logo should be reasonable and recognizable. If other logos are displayed in addition to the project logo, the project logo has to be placed on the same page (or surface) as the other logos.

Please note that the European Union flag emblem – which forms an integral part of the project logo – shall not be smaller than the size of the biggest logo displayed on a same page (or surface), measured either in height or width. Please consult with the JS if in doubt about combining logos.

In addition to the project logo, projects receive a project brand manual with non-binding design templates for publications, plaques, posters, promotional materials etc. All logos and design templates are provided in common digital file formats. However, project communication managers still need to have a basic design expertise for layouting plaques, posters, publications and other communications products.

Branding Infrastructure and Construction Measures

Where the total cost of a project that carries out a physical investment or the purchase of equipment exceeds EUR 100.000, it is obligatory to display durable plaques or billboards as soon as the physical investment starts or purchased equipment is installed. The plaques or billboards need to be clearly visible to the public.

Billboards and permanent plaques have to be made up of at least:

- Project logo;

- Project name;

- Description of the physical investment or the purchased equipment;

- Address of the project website

Where the total cost of a project that carries out a physical investment or the purchase of equipment does not exceed EUR 100.000, at least one poster (minimum size A3) or an equivalent electronic display has to be placed on the site, or (if not possible) at a place nearby readily visible to the public. The poster has to include information about the project as listed above.

Branding Promotional Products

Awareness-raising on a project is the most common reason for purchasing promotional items (give-aways or gadgets). They can be used at events, such as exhibitions and conferences, or in broader awareness campaigns.

Promotional items are by definition produced in larger quantities and come custom-printed with the project logo. They are usually relatively small and inexpensive. Their production has to respect horizontal principles of equal opportunities, non-discrimination, sustainable development and environment protection (see below).

While almost any product can be branded with a project logo and used for promotion, the Interreg CE Programme provides an exhaustive list of common promotional items. The production of promotional items not included in the list below needs a prior approval by the MA/JS, otherwise they are not eligible:

| – Pens and pencils; – (Paper) Notebooks; – Bags (made of sustainable materials like cotton, paper or linen); – Roll-ups. |

Attention: Please note that the above list relates to promotional materials only and does not affect print publications such as brochures, leaflets, postcards, or posters. Projects can produce any kind of print publication as long as it respects the branding rules. Their production does not require prior approval from the MA/JS.

Financial Consequences Linked to Branding

Please note that projects risk financial consequences when they disregard EU and programme branding requirements. If amendments to violated requirements are not possible, the MA/JS may cancel up to 2% of the ERDF co-financing granted to the beneficiary concerned. The financial cuts will be applied to the concerned partner(s) and take into account the principle of proportionality considering the infringement.

I.4.4.3 State Aid

The Notion of State Aid

Public support granted by the Interreg CE Programme must comply with State aid rules. According to Article 107 of the Treaty on the Functioning of the European Union, State aid is defined as “any aid granted by a Member State or through State resources in any form whatsoever which distorts or threatens to distort competition by favouring certain undertakings or the production of certain goods”, therefore affecting trade between Member States.

In practical terms, State aid applies when all five criteria listed below are met:

- The recipient of the aid is an “undertaking”, which is carrying out an economic activity in the context of the project.

- The aid comes from the State, which is always the case for any Interreg programme.

- The aid gives an economic advantage (a benefit), which an undertaking would not have obtained under normal market conditions.

- The aid is selectively favouring certain undertakings or the production of certain goods.

- The aid distorts or threatens to distort competition and affects trade within the European Union.

It is to be noted that the Interreg CE Programme does not support undertakings in difficulty[13], unless authorised under de minimis aid or temporary State aid rules established to address exceptional circumstances.

Furthermore, State aid cannot be granted to export-related activities and aid contingent upon the use of domestic over imported good[14]. Comprehensive information on State aid can be found on the DG Competition website of the European Commission, where also a guideline on the notion of State aid is available[15]. Also relevant national or regional authorities may be consulted to obtain more specific information on rules and limitations concerning State aid (further information might be available on the web pages of the National Contact Points, at the programme website).

State Aid in the Interreg CE Programme

State Aid Assessment and Contractual Conditions

Submitted application forms undergo a specific “State aid assessment” focusing on the five criteria listed above, with particular attention to the assessment of the status as “undertaking” (Criterion 1) of the partners (i.e. the lead partner or any project partner) and of the existence of an economic advantage for the undertaking (Criterion 3).

The results of this assessment may lead to one or more of the following scenarios:

- No State aid relevance. In this case no contractual conditions are set on State aid.

- Risk of State aid that can be removed. In this case, specific obligations are included in the subsidy contract in order to eliminate the State aid cause (e.g. wide dissemination, also to competitors, of certain project outputs).

- Direct State aid granted to one or more partners. In this case the entire budget allocated to the concerned partner is regarded as State aid granted under the General Block Exemption Regulation (GBER)[16] or, in exceptional cases, under de minimis[17] (see below).

- Indirect State aid granted to third parties outside the project partnership. In this case, a contractual condition setting a threshold to the aid granted to third parties is set (see below).

Please note: If the State aid assessment determines that activities to be carried out by partners located in EU Member States outside the programme area are State aid relevant, the participation of these partners will finally not be allowed.

During the implementation of the project, the MA/JS verify that contractual conditions on State aid are fulfilled by the concerned partners (see chapter III.2.3).

Restrictions might apply to the possibility to modify the project if its activities are assessed as State aid relevant. Furthermore, additional contractual conditions on State aid may be given to projects in case of project modifications assessed as State aid relevant.

Direct Aid Granted under GBER

GBER allows to implement a wide range of public support measures without prior notification to the EC as long as all criteria given in the regulation are fulfilled. It includes a block exemption for aid granted in the context of Interreg projects (GBER Article 20).[18] The Interreg CE Programme grants direct State aid under this exemption for which the Interreg CENTRAL EUROPE 2021 – 2027 aid scheme has been set up. The aid granted by the programme amounts to the whole ERDF budget of the concerned partner(s), up to a ceiling of 2,2 million EUR of total public contribution per partner and per project. The full text of the scheme is available under the documents section of the programme website.

It is very important to note that partners receiving the ERDF from the programme under the GBER regime cannot receive any additional public contributions to their budgets.

Partners wishing to apply for any public co-financing scheme for their project budget will receive ERDF from the programme under the de minimis regime (see below). Such partners shall include information on applications for an additional public contribution in section B.1.8 of the application form.

Direct Aid Granted under De Minimis

As an exceptional measure, for partners receiving an additional public contribution to their budgets, the programme may grant the ERDF under the de minimis regime. The aid is granted by the Member State Austria and it amounts to the whole ERDF budget of the concerned partner, as indicated in the application form. Granting aid under de minimis implies that partners can receive funds from the programme only if they did not receive public aid under the de minimis rule totalling more than EUR 300.000 within the previous three years from the date of granting the aid by the Member State Austria.[19]. The Interreg CE Programme does not grant de minimis aid to primary production of agricultural products, nor to aquiculture and fisheries sectors.

The de minimis thresholds counts per “single undertaking”[20]. In case a project partner is part of a group, the entire group is therefore considered as one single undertaking and the de minimis threshold applies to the entire group. This could be for example the case of a company owning (or controlling) one or more companies, or the different departments of a university.

Public aid considered by the programme for the applicable de minimis threshold comprises all aid granted by Austrian national, regional or local authorities, regardless of whether the resources are provided from domestic sources or are partly financed by the European Union.

As a consequence, partners carrying out State aid relevant activities in the project might have a reduction of the ERDF granted by the programme in order to ensure the respect of the applicable de minimis thresholds.

| Example: A private company located in Austria and acting in the IT sector has applied for funding in an Interreg CE project. The total budget of this company in the project is EUR 200.000, out of which the ERDF support amounts to EUR 160.000 (80 % ERDF co-financing). The company will co-finance its project budget (EUR 40.000) through own resources. This company also received a national grant of EUR 150.000 under the de minimis rule in the same year in which it applied for funding by the Interreg CE Programme. According to the de minimis limitation of up to EUR 300.000 of public contribution in three years, the ERDF granted by the Interreg CE Programme to this company shall respect such de minimis threshold. The public contribution that can be granted to this company at the date of signing the subsidy contract amounts to: de minimis threshold (EUR 300.000) – public contribution already received (EUR 150.000) =EUR 150.000 Accordingly, the ERDF contribution granted by the programme amounts to EUR 150.000 instead of EUR 160.000.If this company was located in Germany instead of Austria and – in turn – was receiving the national grant of EUR 150.000 by Germany, the ERDF granted by Austria through the Interreg CENTRAL EUROPE Programme would have remained EUR 160.000 since the ceiling to the accumulation of de minimis aid applies “per Member State”. |

Indirect Aid Granted to Third Parties

Project activities might result in advantages granted to undertakings outside the project partnership that they would not have received under normal market conditions. This might be the case, for example, of free of charge services, training, or consultancy to companies. In such cases, the aid is granted to third parties who are the final beneficiaries of project activities. This aid is granted under GBER Article 20a[21], referring to exemption for aid of limited amount in the context of Interreg.

Aid granted under GBER Article 20a to an undertaking that is the final beneficiary of project activities cannot exceed EUR 22.000. The amount of aid granted to each final beneficiary is to be determined by the concerned partners prior to the implementation of project activities (or part thereof) that are affected by indirect aid, and it shall be approved by the MA/JS.[22] An ex-post approval of the determined amount of aid to final beneficiaries may be granted by the MA/JS in exceptional and duly justified cases.

I.4.4.4 Fundamental Rights, Gender Equality Equal Opportunities and Non-Discrimination

Projects and partners have to respect the fundamental rights[23] as well as the horizontal principles of equal opportunity, non-discrimination and gender equality during all phases of the project lifecycle, i.e. from its design and preparation to its implementation and reporting. In case of non-compliance with the fundamental rights and principles, the institution at fault will be removed from the partnership and any ERDF funds paid to the institution will be recovered in accordance with chapter III.2.6.

Throughout the project lifetime, it has to be ensured that equality between women and men, gender mainstreaming and the integration of a gender perspective are taken into account and promoted. Projects have to describe their specific contributions to horizontal principles in the application form. This will then be assessed for quality and, in case of project selection, monitored by the programme. Any discrimination based on gender, racial or ethnic origin, religion or belief, disability, age or sexual orientation has to be prevented. Accessibility for persons with disabilities shall be taken into account.

Public sector bodies have to ensure compliance with the EU Web Accessibility Directive (EU) 2016/2102 and make their websites and mobile applications more accessible in order to provide persons with disabilities with better access to online public services.

I.4.4.5 Sustainable Development Including Environment Protection

Projects shall fully respect the Union environmental acquis and national legislation on the matter and they shall be in line with the objective of promoting sustainable development, taking into account the UN Sustainable Development Goals[24], the Paris Agreement[25] and the “do no significant harm” principle[26].

Projects should follow an “environmental sustainability by design” approach. This implies that environmental or broader sustainability considerations including human health effects are no longer treated as “after-thoughts”. Instead, they are integrated from the beginning into all activities. Partnerships are strongly encouraged to identify and consider any potentially significant environmental and health issues during project design and consequently choose available options for implementing projects that do not adversely affect the quality of the environment. Rather, projects should ideally contribute to the regeneration of the environment and ecosystem functions and services, climate neutrality as well as the sustainable management and enhancement of cultural landscapes.

I.4.5 Anti-Fraud Policy

The programme Member States and the MA are committed to protect the EU and public funds entrusted against fraud and corruption according to its administrative capacity.

The term fraud is commonly used to describe a wide range of misconducts including theft, corruption, embezzlement, bribery, forgery, misrepresentation, collusion, money laundering and concealment of material facts. It often involves the use of deception to make a personal gain for oneself, a connected person or a third party, or a loss for another – intention is the key element that distinguishes fraud from irregularity. Fraud does not just have a potential financial impact, but can also cause damage to the reputation of the programme bodies.

Corruption is the abuse of power for private gain. Conflict of interests exists where the impartial and objective exercise of the official functions of a person are compromised for reasons involving family, emotional life, political or national affinity, economic interest or any other shared interest with e.g. an applicant for or a recipient of EU funds.

The programme Member States and the MA have a zero tolerance policy to fraud and corruption.

The programme management and control system is set up in view of preventing, detecting and correcting frauds. To this end, the most likely areas for fraud at the programme and projects levels are identified and monitored.

The anti-fraud policy adopted by the MA aims at:

- Promoting a culture which deters fraudulent activities;

- Facilitating the prevention and detection of fraud;

- Supporting the investigation of fraud and related offenses, in order to address such cases in a timely, transparent and appropriate manner.

The responsibility for an anti-fraud culture lies with all those involved in the EU programmes and projects. We therefore encourage all partners, contractors, employees, or the general public to assist in preventing fraud from taking place, putting into place proportionate measures to detect it and making it transparent.

If you suspect fraud or corruption linked to funding from the Interreg CE Programme, please get in touch with the MA.

I.4.6 Resolution of Complaints

Complaints cover any dispute that applicants or beneficiaries may raise with regard to their submitted proposals or approved projects, as well as any dispute with third parties on the implementation of the programme or of the funded project.

Procedures set in place by the programme for the resolution of complaints are differentiated according to the matter concerned, i.e.:

- Complaints related to decisions of the MC on project selection;

- Complaints concerning programme decisions on project implementation.

I.4.6.1 Complaints on Project Selection

Request of Technical Information

Following the MA/JS notification to the lead applicant on the concerned MC decision, and within the timeframe (14 calendar days) available for submitting a formal complaint (see below), the lead applicant may decide to request technical or legal information concerning the MC decision on its project proposal.

The submission of information requests interrupts the deadline for submitting a complaint (see below) until the day the MA/JS replies to the lead applicant. The lead applicant may indicate the preference for a written or oral answer in the submitted request. Oral answers or explanations will be provided by MA/JS staff in charge of the case.

Past experiences show that technical exchanges on this level between the lead applicant and the MA/JS lead to a fast clarification of concerned cases, thus keeping the administrative burden low. It is therefore strongly recommended to submit a request for technical information prior to launching a formal complaint. If, following the MA/JS answer, the lead applicant is not satisfied with the received additional information, it may still decide to submit a formal complaint.

Formal Complaint

Complaints against the project selection process have to be submitted by the lead applicant on behalf of all project partners via e-mail to the MA within 14 calendar days after the notification of the funding decision of the respective call. Complaints received after this timeframe are rejected.

Complaints shall be submitted in English and in written form (scanned letter transmitted by e-mail) to info@interreg-central.eu. The lead applicant shall clearly specify the specific matter of complaint that is deemed to have occurred during the selection process and include clear references to the relevant programme documents (Interreg CE IP document, programme manual or other call-specific documents). If a complaint includes an incomplete description of the case, further information may be requested by the MA/JS at any time of the procedure. If information requested is not provided within the period of time as specified in the request (at least 3 working days), the case shall be closed without further investigation.