Project overview

Co-designed impactful financial instruments for boosting innovation in SMEs and start-ups

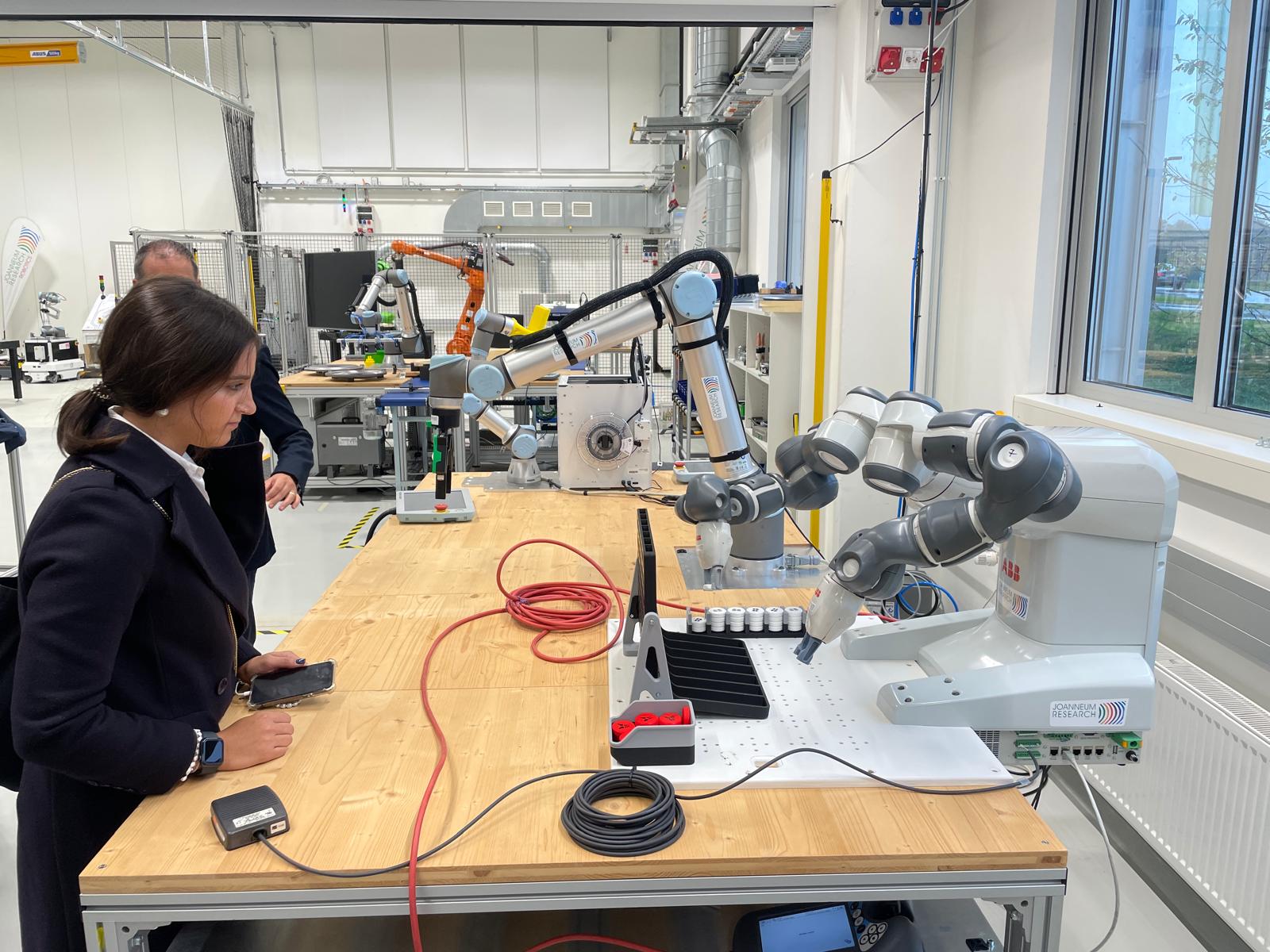

Funding schemes for market-driven research and innovation are rare in central Europe. Finance providers and policy makers often shy away from introducing such schemes due to their complexity. The FI4NN project is changing this by supporting the co-design of new finance instruments in regions that want to boost research and innovation. A knowledge centre promotes innovative instruments that already exist elsewhere and new financial instruments are piloted in seven regions.

-

2,09m €

-

Project Budget

-

80%

-

of the Budget is funded by ERDF

-

8

-

Countries

-

10

-

Regions

-

10

-

Partners

-

7

-

Pilots

Duration

Start date

End date

Project progress

About the project

Project partnership

Project partners

Lead partner

Friuli Innovazione

Project partner

International Projects Department

Financial instruments and grants

9020 Klagenfurt am Wörthersee

Consulting

Sectoral Agency

Roadmap

Challenge

The main challenge of the project is the shortage of effective financial schemes for innovation in Central Europe, especially for SMEs and startups. This leads to issues like limited access to credit, financial difficulties for innovative startups, and underdeveloped Social Impact Investment markets in the region.

Specific Problem

The specific problem is the inadequate access to effective financial schemes for innovation in Central Europe, particularly for Research and Innovation (R&I) activities in SMEs and startups.

Idea

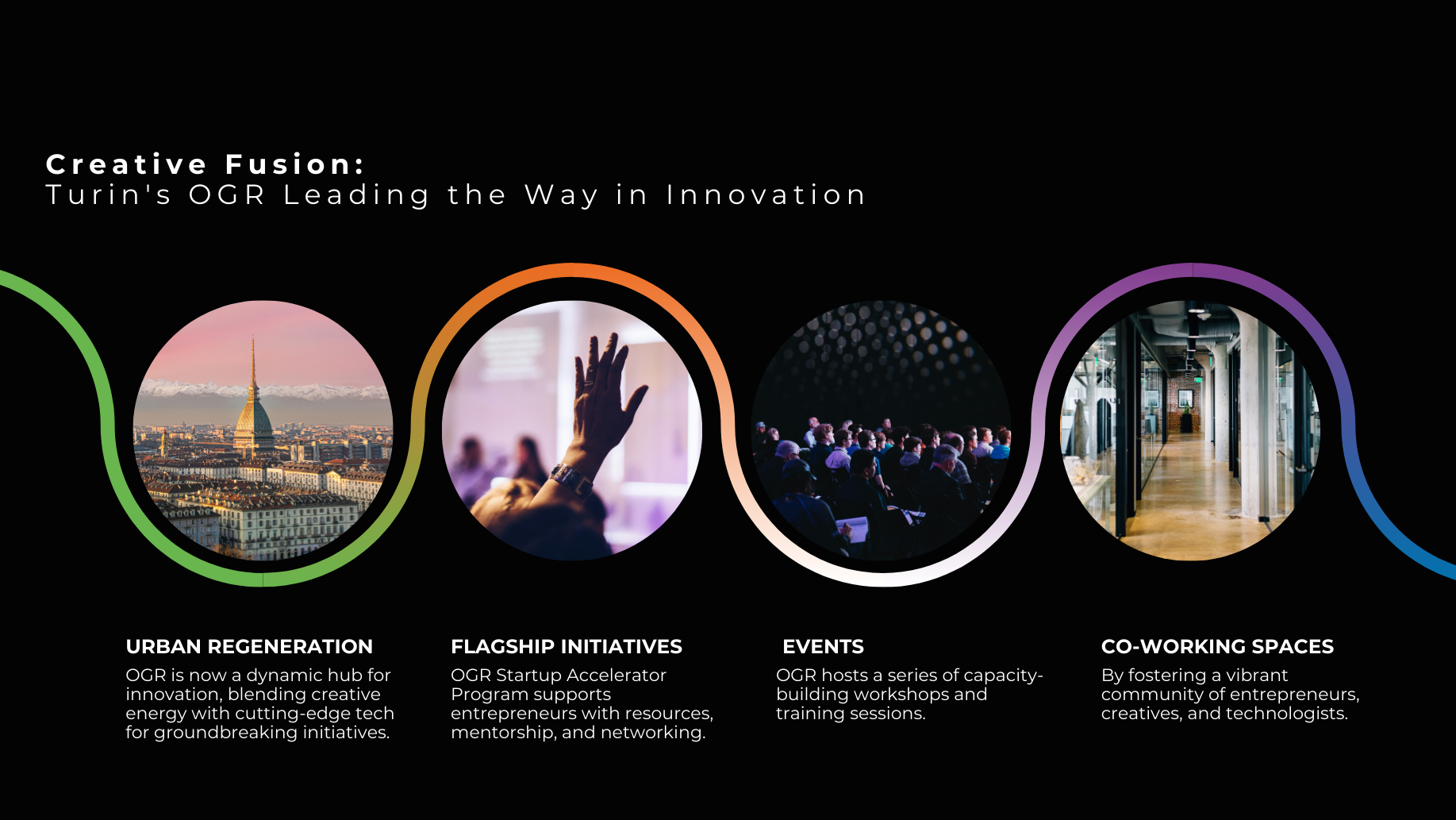

Our idea is to revolutionize and reshape the innovation finance landscape in Central Europe. We aim to create a Virtual Knowledge Center that redefines the old financial schemes. The core concept is to empower innovators, SMEs, startups, and investors by providing them with the tools and resources they need to not only access funding but also foster an environment of collaboration and growth.

Solution

Our solution involves the creation of a user-friendly Virtual Knowledge Center that centralizes resources, funding opportunities, and expertise for innovators, SMEs, startups, and investors. This platform acts as a hub for reimagined financial schemes, innovative financing instruments, and holistic support, with active stakeholder engagement throughout its development.

How it works

1. We will actively involve stakeholders throughout the project's development, including innovators, SMEs, startups, investors, governmental bodies, and regional experts. Regular feedback sessions, surveys, and consultation forums will ensure the platform meets their specific needs. 2. The Virtual Knowledge Center will provide access to an extensive database of innovative funding schemes, which will be curated based on the input of stakeholders to ensure relevancy.

Proof and Credibility

In the next three years we will strengthening innovation capacities and co-design impactful financial instruments for boosting innovation.

Impact

Our mission is to revolutionize the way innovation is funded and unleash the potential of central Europe's brightest minds.

News

Events

Pilot actions

Outputs

1.1. Strategy for a more diversified portfolio of Financing Schemes

- OUTPUT FACTSHEET

- Virtual Knowledge Center

- FACTSHEETS FOR INNOVATIVE FINANCIAL SCHEMES

- Analysis Of SME Satisfaction With The Current Opportunities

- Recommendations To Simplifi FIs Access

- Lessons Learnt Report To Implement Diversified Portfolio O FFinancial Schemes In The CE Region

- 3 Transnational Knowledge Transfer Workshops On Innovative Intervention Models

- Virtual Knowledge Center

1.2. FI4INN network of partners and their associated partners for long term policy collaboration

2.1. Regional piloting of co-design innovative financing schemes for SMEs and Startups

2.2. Solutions

3.1. Strategy for innovation investments' greater accountability through M&E

3.2. Jointly developed regional action plans

FI4INN

The project lead partner is responsible for the content of this project website.